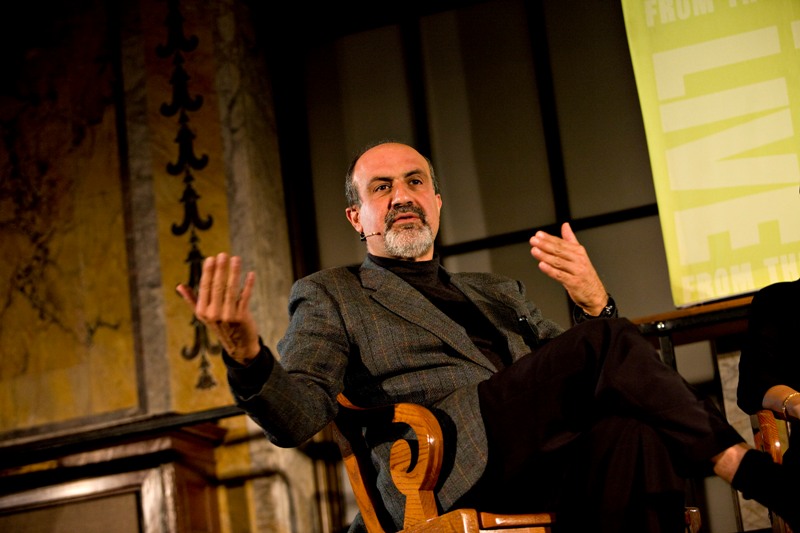

Nassim Taleb Age, Wife, Family, Biography

Quick Info→

Wife: Cynthia Anne Shelton

Nationality: Lebanese-American

Age: 63 Years

| Bio/Wiki | |

|---|---|

| Full Name | Nassim Nicholas Taleb |

| Profession(s) | • Essayist • Mathematical Statistician • Former option trader • Risk Analyst • Aphorist |

| Physical Stats | |

| Eye Colour | Black |

| Hair Colour | Salt & Pepper (Semi Bald) |

| Career | |

| Doctoral advisor | Hélyette Geman (French Academian) |

| Awards | • Bruno Leoni Award • 2018: Wolfram Innovator Award for contributions to decision making under complicated and less-idealized probabilistic structures using Mathematica. |

| Honorary Doctorate | 2016: An honorary doctorate from the American University of Beirut |

| Personal Life | |

| Date of Birth | 12 September 1960 (Monday) |

| Age (as of 2023) | 63 Years |

| Birthplace | Amioun, Lebanon |

| Zodiac sign | Virgo |

| Nationality | Lebanese-American |

| Hometown | Amioun, Lebanon |

| School | Grand Lycée Franco-Libanais, Beirut, Lebanon |

| College/University | • University of Paris, Paris, France • Wharton School, Philadelphia, Pennsylvania |

| Educational Qualification(s) | • Bachelor of Science from the University of Paris • Master of Science from the University of Paris • MBA from the Wharton School at the University of Pennsylvania (1983) • PhD in management science from the University of Paris (Dauphine) (1998) |

| Religion | Christianity |

| Food Habit | Vegetarian/Non-vegetarian |

| Social Media | • Instagram • YouTube |

| Relationships & More | |

| Marital Status | Married |

| Marriage Date | 30 January 1988 |

| Family | |

| Wife/Spouse | Cynthia Anne Shelton |

| Children | Son- Alexander Taleb Daughter- Sarah Taleb |

| Parents | Father- Nagib Taleb (A researcher in Anthropology) Mother- Minerva Ghosn (Oncologist) |

| Other Relatives | Maternal Grandfather: Fouad Nicolas Ghosn (Deputy Prime Ministers of Lebanon in 1940s) Maternal Great-Grandfather: Nicolas Ghosn (Deputy Prime Ministers of Lebanon in 1970s) Paternal Grandfather: Nassim Taleb (Supreme Court Judge) Paternal great-great-great-great-grandfather: Ibrahim Taleb (Governor of Mount Lebanon in 1866) |

Some Lesser Known Facts About Nassim Taleb

Some Lesser Known Facts About Nassim Taleb

- Nassim Taleb belongs to a Greek Orthodox Christian family in Lebanon. His family had a huge political influence in Lebanon and held French citizenship.

- During one summer while he was in school, he decided to read the twenty novels by the French novelist Emile Zola in twenty days, one a day; he was able to do so.

- According to him, he became interested in Marxist studies at an early age as he joined a secret underground Trotskyist cell. At the same time, he got published in a local newspaper.

- Taleb actively took part in various student riots and according to him, he was also jailed once for assaulting a policeman during a student riot.

- After completing his schooling, he moved to Paris to pursue graduation and in

- A civil war began in Lebanon when Nassim turned 15. According to him, he saw Lebanon’s transformation from heaven to hell during the civil war in 1975. His school was damaged during the war.

- In 1982, his family’s home in Amioun, in northern Lebanon, was also destroyed due to the civil war. At the age of 19, he moved to the United States to pursue further studies.

- While pursuing his graduation at the Wharton Business School, he realised that he wanted to specialise in a profession linked to probability and rare events.

- According to him, at the time he felt that there was a fraud somewhere, that “Six Sigma” events (measures of rare events) were miscomputed and there was no basis for their computation. Therefore, he went to a bookstore and ordered all the books with “probability” or “stochastic” in its title.

- He read all the books but it led to nothing; however, according to him, it became his best investment as it turned out to be the topic he knew the best.

- After graduation, he became a Derivatives Trader. Later, he held senior positions at various financial institutions including Credit Suisse First Boston, UBS, BNP-Paribas, Indosuez (now Calyon), and Bankers Trust (now Deutsche Bank).

- Later, he started his own derivatives firm and ran it for 6 years.

- During the mid-1990s, Nassim decided to take a turn in his career. He spent most of his time in an attic at his home in New York City. He studied and researched for 14 hours straight for 7 days a week about probability theory, numerical analysis, and mathematical statistics.

- As a result of all the research, he wrote a six hundred pages long discussion of managing nonlinear effects, with graphs and tables which was later published as a book titled Dynamic Hedging: Managing Vanilla and Exotic Options (1997).

- After publishing his book, he began working on his PhD. in Paris which was titled The Microstructure of Dynamic Hedging which focused on the mathematics of derivatives pricing.

- In December 1999, he was appointed as a Fellow in the Mathematics Finance Program and an Adjunct Professor of Mathematics at Courant Institute of Mathematical Sciences of New York University and he remained until December 2005.

- In 2001, he published another book titled “Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets.”

- In January 2005, he began working as the Dean’s Professor of Decision Sciences at the University of Massachusetts, Amherst, United States. He worked there for a year.

- During this time, he also worked as a derivatives trader and after completing 21 years working as a derivatives trader also closing 650,000 option transactions and examining 200,000 risk reports, Taleb decided to change his career in 2006 to become a scholar, mathematical researcher and philosophical essayist.

- In 2007, Taleb published a book titled “The Black Swan: The Impact of the Highly Improbable.” The book sold over 3 million copies over the years and was translated into more than 30 languages. The Sunday Times named the book as one of the twelve most influential books since the Second World War.

- In 2007, he published a research paper titled “The pseudo-science hurting markets” in which he asked for the cancellation of the Nobel Prize in Economics claiming that “the damage from economic theories can be devastating.” He also urges that banks should be treated as utilities forbidden to take potentially lethal risks whereas hedge funds and other unregulated entities should be able to do what they want.

- After changing his career in 2006, he held various positions at different educational institutes including NYU’s Courant Institute of Mathematical Sciences, University of Massachusetts Amherst, and London Business School, and at Oxford University.

- In 2008, he began working as the Distinguished Professor of Risk Engineering at New York University Tandon School of Engineering.

- From 2009 to 2013, he served as the Distinguished Research Scholar at the Said Business School BT Center, University of Oxford, England.

- In 2009, he was included on the Forbes magazine list of “Most Influential Management Gurus.”

- In 2011, he was featured on the Bloomberg 50 Most Influential People in Global Finance.

- Taleb has been featured in the Most Influential 100 Thought Leaders in the World by the Gottlieb Duttweiler Institute thrice consecutively for three years in 2013, 2014, and 2015.

- In September 2014, he began working as the co-editor in Chief of the academic journal Risk and Decision Analysis.

- In May 2017, he appeared as a special guest on The Ron Paul Liberty Report podcast and showed his support for a non-interventionist foreign policy.

- In 2022, he publically supported Ukraine and denounced “naive libertarians, who think I’m like them because they like my books.

- He actively participates in teaching courses toward the Certificate in Quantitative Finance and is also a co-faculty at the New England Complex Systems Institute.

- According to various reports, Taleb became financially independent after the crash of 1987 and was also successful during the Nasdaq dive in 2000 and the financial crisis that began in 2007.

- As per a Wall Street Journal article published in 2007, Taleb retired from trading in 2004 and became a full-time author. The article also described his involvement as “totally passive” from 2010.

- Taleb believes that universities are better at public relations and claiming credit than generating knowledge.