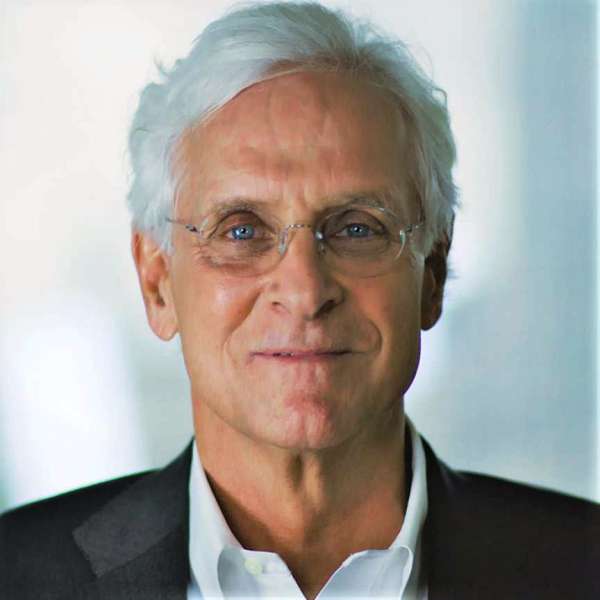

Steve Koltes Age, Wife, Family, Biography & More

| Bio/Wiki | |

|---|---|

| Full name | Steve Frederick Koltes [1]Chestnut Hill Local |

| Profession(s) | Banker, Entrepreneur |

| Physical Stats & More | |

| Height (approx.) | in centimeters- 180 cm in meters- 1.80 m in feet & inches- 5’ 11” |

| Eye Colour | Hazel Blue |

| Hair Colour | White |

| Career | |

| Personal Life | |

| Date of Birth | March 1956 |

| Age (as of 2023) | 67 Years |

| Birthplace | United States of America |

| Nationality | Not known |

| School | William Penn Charter School, Philadelphia, USA (till Class 10) Note: He completed his schooling in Germany, where he went under a youth exchange program in 1974. |

| College/University | Middlebury College, Vermont, US |

| Educational Qualification | BA |

| Relationships & More | |

| Marital Status | Married |

| Marriage Date | Year, 1988 |

| Family | |

| Wife/Spouse | Corinne |

| Children | Son- Troy Daughter- Kalya |

| Parents | Father- John Albert Koltes (doctor, he died in 2011) Mother- Nancy Hare Koltes (deceased; she passed away on 6 September 2013) |

| Siblings | Brother- 1 • John Albert Koltes Sister(s)- 2 • Karen Hare Koltes • Nancy Gilbert Koltes |

Some Lesser Known Facts About Steve Koltes

- Steve Koltes is a Switzerland-based American banker and businessman. He is the co-founder of Europe’s largest private equity firm CVC Capital Partners.

- In seventh grade, Steve wanted to learn French, but he was not allowed to pursue the language as there was no vacancy for the subject in the school due to which he decided to opt for German. While giving an interview, Steve talked about it and said,

I was in seventh grade, and we had to pick up a language. So, I picked French. I have no idea why I picked French, but I took French. I was just twelve years old, and at that age you ca nott expect a great judgment call on languages. Then I was told that the French class was full. Just filled up, and you have to pick another language. So I picked up German. I have got no idea why I picked German, but I picked German.”

- Upon completing his formal education, Steve got employed by Citigroup as an executive officer and worked in the organisation in Zurich, London, and New York, looking after its corporate banking and corporate finance.

- He assumed the position of managing director at Citicorp Venture Capital London in 1982.

- Steve Koltes, Michael Smith, Hardy McLain, Donald Mackenzie, Iain Parham, and Rolly Van Rappard purchased Citicorp Venture Capital London after making a deal with Citicorp in 1993 and later renamed it CVC Capital Partners.

- On 27 January 2000, Koltes was appointed as a director at Automotive Sealing Systems Limited; he held the appointment till 20 February 2002.

- From 17 December 2003 to 20 July 2008, Steve Koltes served as the director of CVC Advisers Limited.

- Koltes replaced Michael Smith and became the chairman of CVC Capital Partners along with Donald Mackenzie and Rolly Van Rappard in 2012.

- He won the William Penn Charter School’s Alumni Award of Merit in 2014.

- CVC Capital Partners bought Sky Betting & Gaming, a gambling company situated in the United Kingdom, in 2015.

- Thereafter, CVC Capital Partners bought Starbev, an alcoholic beverage-manufacturing company, Samsonite, a suitcase-making company, and the printing systems division of Badische Anilin und Soda Fabrik (BASF).

- Later, the organisation purchased Formula One, but it was sold for $8 billion to Liberty Media, owned by John Carl Malone, after incurring unsustainable losses.

- Later, he served at Evonik Industries and Elster Group as its board member.

- CVC Capital Partners spent Rs. 5,600 crores on purchasing an IPL team named Gujarat Titans in 2021.

- Steve Koltes stepped down from the chairmanship of CVC Capital Partners in October 2022. He, however, shall continue to work with the company in a non-executive capacity as a member of its board. While giving an interview, Donald Mackenzie, Steve’s close friend and business partner, talked about Steve stepping down from the chairmanship and said,

In all his years with the firm Steve has been a tower of both wisdom and determination and will be missed by all of us. He leaves CVC as a world leading investment firm with a superb team and a wealth of opportunities for further growth. Steve and I have been good friends, business partners and fellow deal-makers from the very earliest days of CVC. I will greatly miss his balance and his stewardship of the culture of CVC, and I know that everyone in CVC feels the same.”

- For acquiring many global companies, the trio Steve Koltes, Donald Mackenzie, and Rolly Van Rappard are called as the buyout kings of Europe. [2]Daily Mail

References/Sources: