Ashish Kacholia (Businessman) Age, Wife, Children, Caste, Family, Biography & More

Quick Info→

Caste: Marwari

Profession: Businessperson

Wife: Sushmita Kacholia

| Bio/Wiki | |

|---|---|

| Full name | Ashish Ramesh Kacholia [1]The Economic Times |

| Name earned | Big Whale of Dalal Street [2]The Economic Times |

| Profession(s) | Businessman and Investor |

| Famous for | His excellent skills to identify multi-bagger stock. |

| Physical Stats & More | |

| Height (approx.) | in centimeters- 177 cm in meters- 1.77 m in feet & inches- 5’ 10” |

| Eye Colour | Black |

| Hair Colour | Bald |

| Career | |

| Portfolio | According to corporate shareholdings disclosed for 30 June 2023, Ashish Kacholia publicly owns 40 securities with a net worth of over Rs. 2,009.7 crores. [3]Trendlyne |

| Personal Life | |

| Age (as of 2023) | He is in his 50s [4]The Economic Times |

| Birthplace | Mumbai, India |

| Nationality | Indian |

| Hometown | Mumbai, India |

| College/University | Jamnalal Bajaj Institute of business Studies (JBIMS), Mumbai |

| Educational Qualifications [5]Zee News | • Bachelor of Science in Production Engineering • Master of Business Administration |

| Caste | Marwari [6]Vinayak Lohani |

| Relationships & More | |

| Marital Status | Married |

| Marriage date | 27 April 2009 |

| Family | |

| Wife/Spouse | Sushmita Ashish Kacholia (stockmarket investor) |

| Children | He has three children. |

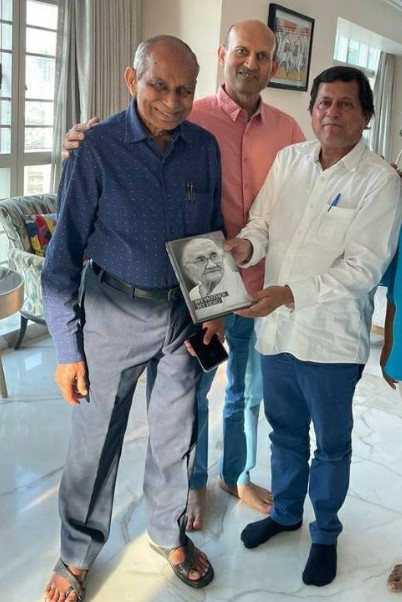

| Parents | Father- Ramesh Kacholia (businessman, philanthropist, social worker) Mother- Name Not Known |

| Money Factor | |

| Net Worth (approx.) | Rs. 2,036 crores [7]Zee News |

Some Lesser Known Facts About Ashish Kacholia

- Ashish Kacholia is an Indian businessman and stock market investor. Ashish Kacholia, along with Rakesh Jhunjhunwala, co-founded Hungama Digital in 1999. In 2003, he started his own company called Lucky Securities. Ashish Kacholia is well known for investing in various types of companies such as hotels, education, infrastructure, and industrial sectors in India.

- He started his career at Prime Securities and briefly worked at Edelweiss Capital before starting Lucky Securities in 2003. Kacholia began as a small investor who put most of his assets into stocks, but over time, he developed a keen eye for finding potential stock market companies with a lot of possibility for growth.

- According to media reports, Ashish Kacholia is a devoted fan of Warren Buffett. According to Kacholia, a company’s management is one of the most crucial factors to consider while investing because their ability to carry out plans can make or break the success of the organisation. He contends that companies that can adapt to evolving market trends and customer preferences are more likely to succeed in the long run.

- Kacholia is an investment expert for many newcomers who aspire to succeed in the stock market like him. Reportedly, Kacholia can spot the best multi-bagger stocks. Ajanta Pharma and Mastek Limited are two notable companies that he discovered in 2012 and 2016, respectively. Whenever Kacholia changes his ownership stake in a company or adds any shares to his portfolio, market participants pay close attention. He has investments in Atul Auto, Majesco, KPIT Technologies, Polycab India, and other well-known investment companies.

- Kacholia is one of those successful Indian investors who earned above 2000% return on investment in Bodal Chemicals Ltd. from 2013 to 2018.

- Once, Ashish Kacholia received a 400% return on his investment in Majesco, an Insurance Technology Company, in nine months. In the same year, his portfolio grew by 150%, which made him the richest investor in India of that year.

- According to some media reports, he had a 1.4% stake in Paushak Limited in November 2020. These shares earned him a 100% return in one month when the cost of this stock rose to Rs 8,067 per share in December 2020.

- Ashish Kacholia invested in Igarashi Motors during the third quarter of 2021 and acquired a 1.27% share in the business. According to the media reports, he bought 3,99,550 shares of this corporation, and his ownership share is worth Rs. 14 crores. In December 2021, he made investments in Genesys International Corporation. The shares of this company returned between 170% to 500% in 2021.

- Kacholia prefers to live a modest lifestyle and avoids being in the public eye. Once, in a media interview, he stated that he was a private person. He said,

I am a private person. Bull markets create heroes and bear markets create zeroes. So, I’d rather stay anonymous.”

- Till 2023, Ashish Kacholia has invested in more than 40 equities in renowned companies with high valuations. In 2023, he invested 3.75% in Acrysil Ltd. and 2.24% in NIIT Ltd., which are two major Indian companies. During the same year, his shares were valued at around Rs. 71 crores in Acrysil Ltd. and Rs. 141 crores in NIIT Ltd. Reportedly, Ashish Kacholia seeks out the best small and mid-cap investment prospects. He has stable financial stakes in Poly Medicure Ltd., Shaily Engineering Plastic Ltd., and Safari Industries (India) Ltd. Along with these businesses, he also holds a sizeable investment in several other highly-regarded publicly traded businesses.

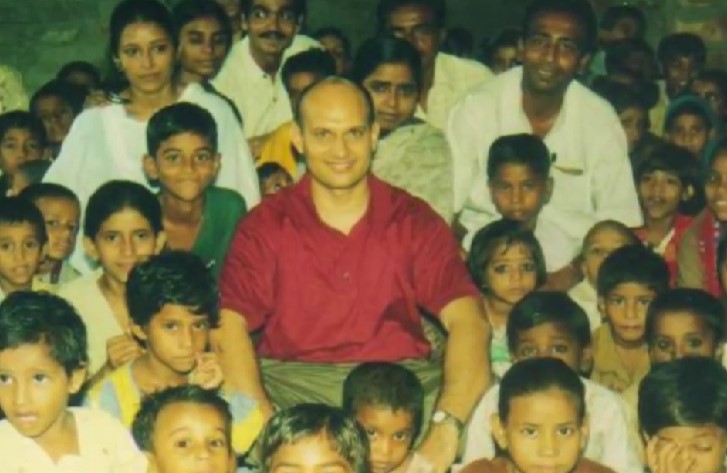

- Besides being a private investor, Ashish Kacholia is a renowned philanthropist. He is associated as an individual donor in Caring Friends. In 2002, his father, Ramesh Kacholia, founded Caring Friends, a non-profit organisation based in Mumbai. Ramesh Kacholia is a prominent philanthropist in India and supports more than 40 NGOs, including Snehalaya.

References/Sources: