Radhakishan Damani Age, Wife, Children, Family, Biography & More

| Bio/Wiki | |

|---|---|

| Nickname | Mr. White and White [1]Business Today |

| Names Earned | Retail King of India [2]Business Connect |

| Profession(s) | Businessman, Stockbroker, Investor |

| Famous For | Founding the supermarket chain DMart |

| Physical Stats & More | |

| Eye Colour | Black |

| Hair Colour | Salt & Pepper (semi-bald) |

| Personal Life | |

| Date of Birth | 1954 [3]Business Today |

| Age (as of 2021) | 67 Years |

| Birthplace | Bikaner, Rajasthan |

| Nationality | Indian |

| Hometown | Mumbai |

| College/University | University of Mumbai |

| Educational Qualification | College dropout (1st year B.Com.) [4]The Economic Times |

| Ethnicity | Marwari [5]The Economic Times |

| Food Habit | Vegan [6]The Economic Times |

| Address | Altamount Road, Mumbai |

| Hobby | Taking a walk on Girgaum Chowpatty |

| Relationships & More | |

| Marital Status | Married |

| Family | |

| Wife/Spouse | Shrikantadevi Radhakishan Damani |

| Children | Daughter- 3 • Manjri Damani Chandak  • Jyoti Kabra  • Madhu Chandak  |

| Parents | Father- Shivkishanji Damani (stockbroker) Mother- Name Not Known |

| Siblings | Brother- Gopikishan Damani (investor) |

| Money Factor | |

| Assets/Properties | • a 156-room Radisson Blu Resort in Alibag, Maharashtra • a beachfront getaway home close to Mumbai [7]Forbes |

| Net Worth (approx.) | $17.2 billion (as of March 2024) [8]Forbes Note: In March 2024, he became the ninth richest person in Indi. |

Some Lesser Known Facts About Radhakishan Damani

- Radhakishan Damani (RD) is a famous Indian businessman, who is termed as the Retail King of India. He is the fourth richest Indian as of 2021. [9]Forbes

- RD dropped out in the first year of his college to start his ball-bearing business, and his father and brother were stockbrokers on Dalal Street.

- After the untimely death of his father, Mr. Damani was forced to close down his business and join his brother as a stockbroker. He made his first financial investment at the age of 32.

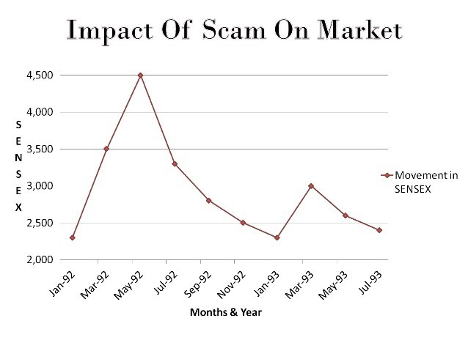

- During RD’s initial years on Dalal Street, the market was ruled by the dreaded bear Manu Manek (nicknamed the Cobra by the brokers who disliked him). Radhakishan learned the strategies of shorting the stocks from Manu Manek, and later, he applied the same strategies to short the overpriced stocks of the Big Bull, Harshad Mehta.

- Mr. Damani was not very popular in the 1980s. Stockbrokers used to call him ‘GS’ as it was written on his entry badge (used to enter the trading ring). In an interview, Deena Mehta (another famous stockbroker) described the early days of Mr Damani on Dalal Street by saying,

He merely stood there and watched; he rarely called out trades… he would just stand idle and understand the pulse of the market.”

- Reportedly, RD was part of a group, ‘triple-R,’ in the late ’80s. The group comprised of Radhakishan Damani, a chartist named Raju, and the future Big Bull of stock market Rakesh Jhunjhunwala. Triple-R was famous for perpetuating the bearish trend in the stock market, rivalling the bullish ideologies of Harshad Mehta.

- Reportedly, Harshad and the group of Mr. Damani first competed with each other over the shares of Apollo Tyres. RD felt the value of the share was overpriced and began short selling the stock; however, Harshad manipulated the price of the share with his illegal funding. Mr. Damani and his friends faced huge losses at that time.

- After the financial scam of 1992 was exposed, a lot of people suffered huge losses. In an interview, post the exposure of the scam, Mr. Damani said,

Agar Harshad saat din aur apni position hold kar leta, toh mujhe kathora leke road par utarna padta.”

- RD is known to have helped many small times investors (who owed him money) by buying their undervalued stocks. He did the same thing by helping a fellow stockbroker, Deena Mehta, after the market crash of 2001 (Ketan Parekh Scam). In an interview, while talking about Mr. Damani’s gesture, Deena quoted,

When some of our clients got trapped in Videocon and BPL shares, RD helped us by taking over their positions… These scrips had become unsalable as there were no buyers in the market. RD is a very positive player in times of crisis. He’s a shrewd investor; makes more money when he’s bearish.”

- The King of Stock Market Rakesh Jhunjhunwala acknowledges Radhakishan Damani as his market guru. In an interview, Rakesh said,

I learnt trading from him … He has wisdom, extreme patience and humility … The patience he has to hear the other person’s point of view is unbelievable … He taught me life and shaped my nature. If he and my father had not been there to guide me, I would not have achieved such success.”

- Mr. Damani’s prominent investments include shares of VST Industries, HDFC, Sundaram Finance, ITC, Gillette, Crisil, ICRA, 3M India, Blue Dart Express, Prozone Intu Properties, Uniply Industries, and India Cements. He has also purchased 1% stake in Andhra Paper.

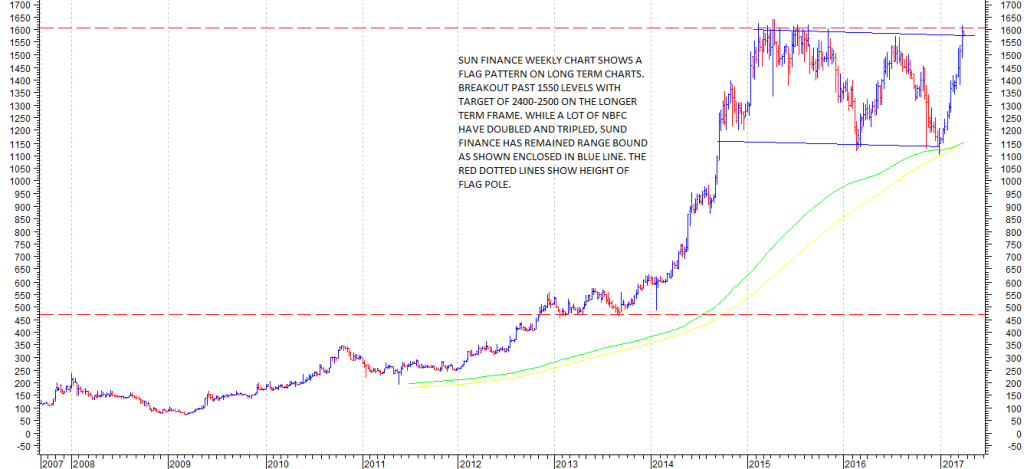

- RD bought the stock of VST Industries Ltd at Rs. 80 per share in 2000; the price skyrocketed to Rs. 3600 in 2020. He also bought Sundaram Finance at Rs 270 per share, which is now trading at Rs. 1800 as of 2021.

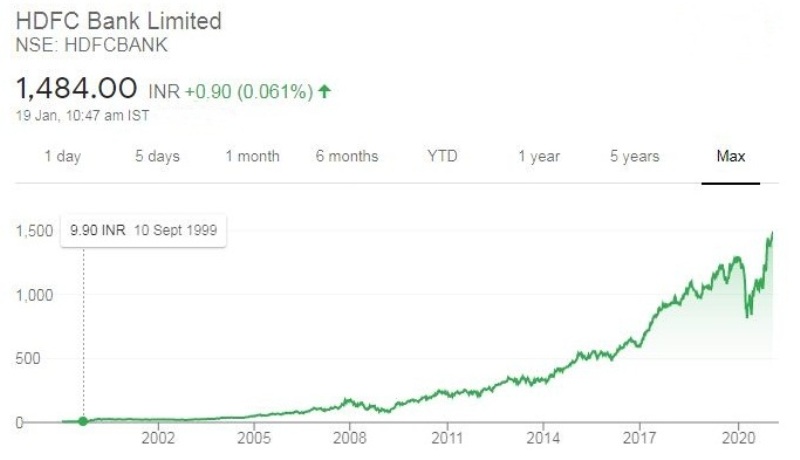

- Radhakishan Damani’s other major investment was buying Rs. 400 crores worth of HDFC Bank’s shares at Rs. 40 per share when the HDFC IPO went public in 1995. The stock rose to Rs 2600 in 2020. It is rumoured that RD was advised to buy the shares of SBI instead of HDFC to which he replied by saying,

Dharavi Dharavi hota hai, aur Pedder Road Pedder Road… aage jaake HDFC ka bhaav dekh lena.”

- In an interview, Radhakishan admitted that he was inspired by the veteran investor Chandrakant Sampat, who was known for his value investments in the ’80s and ’90s. It is also rumoured that Sampat gave a tip to Mr. Damani about Gillette India.

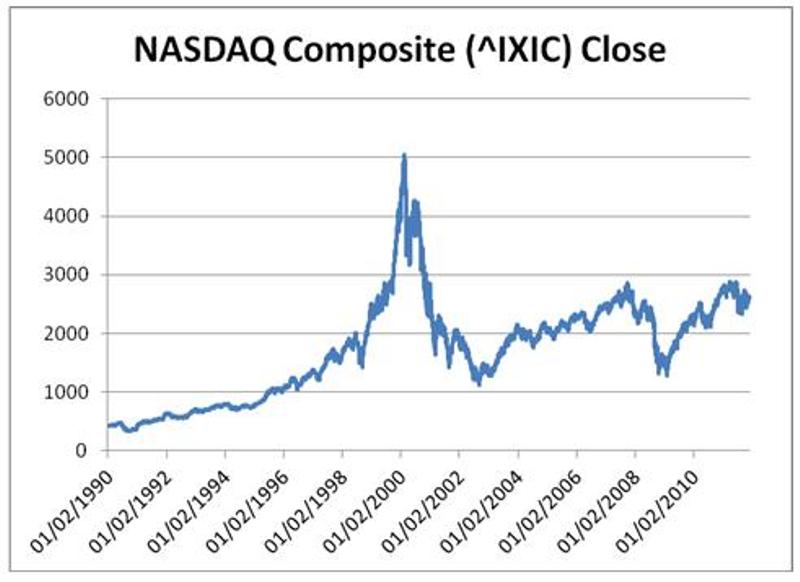

- RD is considered a shrewd and far-sighted businessman as he was able to predict the dot-com bubble of 2001 (a market crash caused by the excessive use of the internet by the trading companies that led to a lot of conjecture about trading) and the global recession of 2008.

- After his successful venture at the stock market, the maverick of the stock market shifted his focus to the retail business. He bought a franchise of Apna Bazar in 1998, but he was not convinced by the market strategies of Apna Bazar. So, in 2002, Mr. Damani founded a retail chain of supermarkets and named it DMart (registered as Avenue Supermarts Ltd.). He started with one store in Powai in 2002; as of 2020, Dmart has 216 stores across India.

- RD launched the IPO of DMart in March 2017 with a price of Rs. 299 per share. The stock is trading at around Rs. 2900 as of 2021. The net valuation of the company rose from Rs 38,000 crore (in March 2017) to Rs 1.5 lakh crore by June 2020.

- There is a role based on the life of Radhakishan Damani in SonyLIV’s hit web series, Scam 1992: The Harshad Mehta Story. The role was played by actor Paresh Ganatra.

- He is nicknamed Mr. White & White by his close friends because of his habit of wearing only white shirts and white pants. According to him, it helps him save time every morning.

- Radhakishan Damani is very reserved and shy, and he hardly gives interviews to the media and stays away from market-related events.

References/Sources: